Outsourced Accounting & Advisory Services

Give your business an unfair advantage

Your business data is a catalyst for growth. Especially your accounting data if you’re a small to mid-size manufacturer not quite ready to hire the talent you need to tap into it. Our dedicated experts combine clean, accurate financial accounting and operational data with best-in-class tools and CFO-level guidance. Everything you need to make smart decisions about the future of your business.

Manufacturing accounting done right

“Chortek understands the manufacturing industry inside and out… they were able to identify opportunities I didn’t even know were available and offer thorough advice on how to best continue growing my business.”

– Eric Spacek, Owner, Atlas Gaskets

Our services

How we can help

When it comes to manufacturing, experience matters. Our team of accounting specialists is dedicated to manufacturing. Whether you’re looking to take your business to the next level with real-time analytics or aiming to optimize your accounting function by outsourcing – we’re here to help.

Our process

Best-in-field expertise meets best-in-class tools

Business software is the Achille’s heel of many small to mid-size businesses. And this couldn’t be truer than in manufacturing, where different systems don’t always work well with one another, or data sit in silos.

Our team of professionals has deep experience in manufacturing and is equipped with some of the latest advancements in business intelligence.

We’ll take your day-to-day accounting (bookkeeping) tasks off your plate and ensure that everything ties out. This will allow our advisors (fractional CFO/controller) to collaborate with you using clean, timely information to proactively plan for the road ahead.

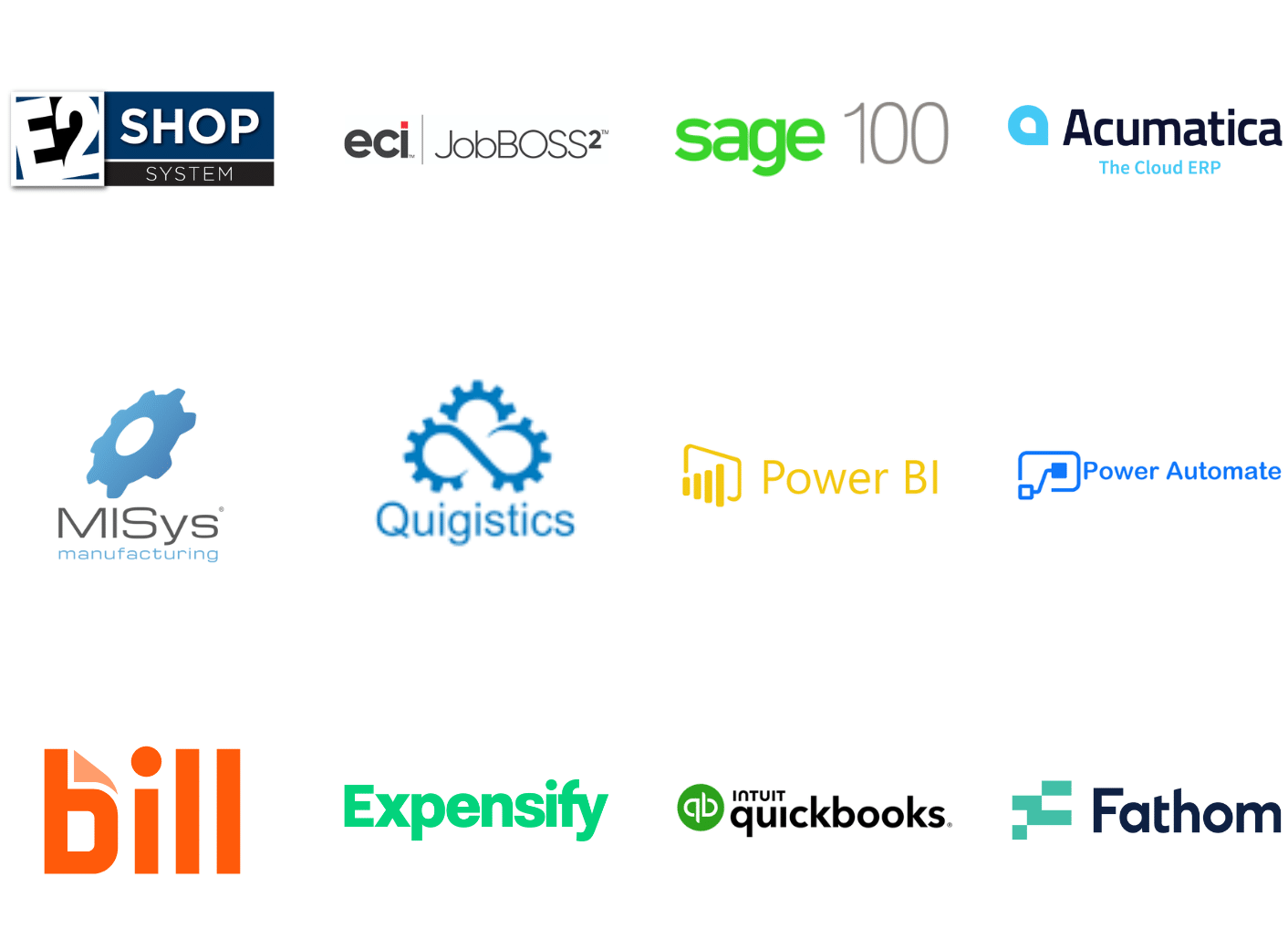

Our tools

A few of our favorite tools

If you run a job shop using JobBOSS2, E2, MISys, Acumatica, or Sage 100 or are a food or beverage manufacturing facility running on Quigistics, you won’t find a better fit for your outsourced accounting and advisory needs. If you use other systems or are in other industries, we’d love to hear from you too. We’re always looking for new industries to serve.

Outsourced Accounting & Advisory Services

Give your business an unfair advantage

Your business data is a catalyst for growth. Especially your accounting data if you’re a small to mid-size manufacturer not quite ready to hire the talent you need to tap into it. Our dedicated experts combine clean, accurate financial accounting and operational data with best-in-class tools and CFO-level guidance. Everything you need to make smart decisions about the future of your business.

Manufacturing accounting done right

“Chortek understands the manufacturing industry inside and out… they were able to identify opportunities I didn’t even know were available and offer thorough advice on how to best continue growing my business.”

– Eric Spacek, Owner, Atlas Gaskets

Our services

How we can help

When it comes to manufacturing, experience matters. Our team of accounting specialists is dedicated to manufacturing. Whether you’re looking to take your business to the next level with real-time analytics or aiming to optimize your accounting function by outsourcing – we’re here to help.

Our process

Best-in-field expertise meets best-in-class tools

Business software is the Achille’s heel of many small to mid-size businesses. And this couldn’t be truer than in manufacturing, where different systems don’t always work well with one another, or data sit in silos.

Our team of professionals has deep experience in manufacturing and is equipped with some of the latest advancements in business intelligence.

We’ll take your day-to-day accounting (bookkeeping) tasks off your plate and ensure that everything ties out. This will allow our advisors (fractional CFO/controller) to collaborate with you using clean, timely information to proactively plan for the road ahead.

Our tools

A few of our favorite tools

If you run a job shop using JobBOSS2, E2, MISys, Acumatica, or Sage 100 or are a food or beverage manufacturing facility running on Quigistics, you won’t find a better fit for your outsourced accounting and advisory needs. If you use other systems or are in other industries, we’d love to hear from you too. We’re always looking for new industries to serve.

Related Resources

Your resource for more information on manufacturing best practices in accounting and data analytics.