Meals and Entertainment Deduction – 2021 Updated Information

Are you up to date with the latest changes on meals and entertainment deduction rules for 2021? These deduction changes, which are in place for a limited time period, may prompt some changes to the taxpayer’s general ledger for a few years to assist with capturing the data at the time of recording the transaction.

The infographic with the latest updates are below. If you have any questions about the changes, feel free to contact a member of the Chortek team.

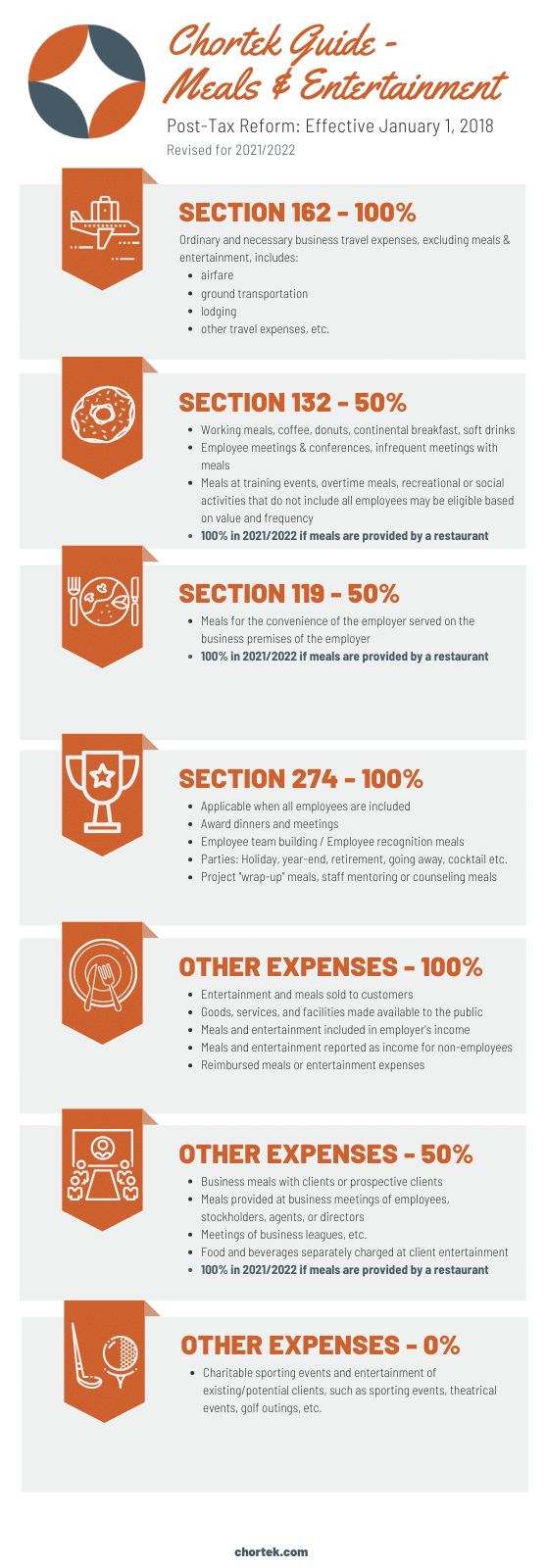

Text in the infographic:

Chortek Guide: Meals & Entertainment

Post-Tax Reform: Effective January 1, 2018

Revised for 2021/2022

Section 162 – 100%

Ordinary and necessary business travel expenses, excluding meals & entertainment, includes:

- airfare

- ground transportation

- lodging

- other travel expenses, etc.

Section 132 – 50%

- Working meals, coffee, donuts, continental breakfast, soft drinks

- Employee meetings & conferences, infrequent meetings with meals

- Meals at training events, overtime meals, recreational or social activities that do not include all employees may be eligible based on value and frequency

- 100% in 2021/2022 if meals are provided by a restaurant

Section 119 – 50%

- Meals for the convenience of the employer served on the business premises of the employer

- 100% in 2021/2022 if meals are provided by a restaurant

Section 274 – 100%

- Applicable when all employees are included

- Award dinners and meetings

- Employee team building / Employee recognition meals

- Parties: Holiday, year-end, retirement, going away, cocktail etc.

- Project “wrap-up” meals, staff mentoring or counseling meals

Other Expenses – 100%

- Entertainment and meals sold to customers

- Goods, services, and facilities made available to the public

- Meals and entertainment included in employer’s income

- Meals and entertainment reported as income for non-employees

- Reimbursed meals or entertainment expenses

Other Expenses – 50%

- Business meals with clients or prospective clients

- Meals provided at business meetings of employees, stockholders, agents, or directors

- Meetings of business leagues, etc.

- Food and beverages separately charged at client entertainment

- 100% in 2021/2022 if meals are provided by a restaurant

Other Expenses – 0%

Charitable sporting events and entertainment of existing/potential clients, such as sporting events, theatrical events, golf outings, etc.