How the “One Big Beautiful Bill” Helps Manufacturers Invest in Automation

October 01, 2025

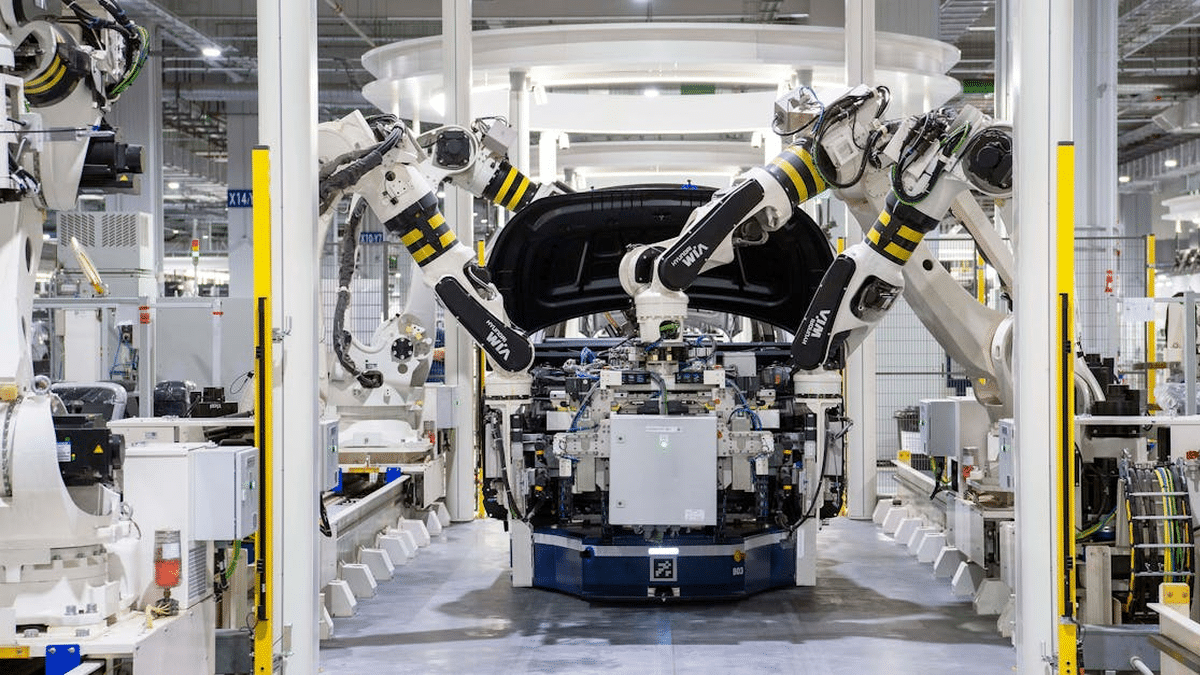

According to the 2025 Wisconsin Manufacturing Report, 72% of manufacturers believe automation is important to their company’s future; however, the primary obstacle to implementation is budget and financing. That means even though most manufacturers see automation as critical, many are struggling to make the numbers work.

The newly enacted One Big Beautiful Bill Act (OBBB) could change that. With powerful new tax incentives and accelerated depreciation, this legislation makes it easier for manufacturers to afford and justify investments such as automation.

In this article, we break down the key provisions in the One Big Beautiful Bill that can help your business modernize, automate, and grow.

1. 100% Bonus Depreciation: Immediate Write-Offs for Equipment

The law permanently restores full 100% bonus depreciation for qualifying property acquired and placed in service after January 19, 2025. For property acquired before that date but placed in service during 2025, manufacturers can elect to use the enhanced depreciation rates. This allows manufacturers to fully expense the cost of qualifying machinery and equipment, including robotics, CNC systems, AI-enabled production equipment, and automated material handling systems, in the year it’s placed in service.

Why it matters: For automation projects often running into six or seven figures, immediate expensing can dramatically improve cash flow and ROI. Unlike the previous phase-down schedule that would have reduced bonus depreciation to 40% in 2025, the OBBB makes 100% bonus depreciation permanent.

Example: A manufacturer investing $2 million in robotic assembly equipment can now deduct the entire amount in 2025, potentially saving $420,000 in federal taxes (at the 21% corporate rate) in the first year alone.

2. New 100% Depreciation for Qualified Production Property (QPP)

Beyond traditional bonus depreciation, the Act introduces an elective 100% depreciation allowance for Qualified Production Property (QPP), nonresidential real property that serves as “an integral part” of manufacturing activities. This includes production floors, manufacturing bays, equipment installation areas, and specialized production facilities.

Key Requirements:

- Construction must begin after January 19, 2025, and before January 1, 2029

- Property must be placed in service before January 1, 2031

- Must be used directly in manufacturing, production, or refining activities

- Excludes offices, parking, administrative services, sales activities, R&D labs, and engineering areas

Important Note: A recapture rule applies if the QPP is used for non-manufacturing purposes within 10 years of claiming the deduction.

How it helps: If you’re expanding production capacity with automation-ready layouts, building new robotic cells, or constructing specialized manufacturing spaces, these facility improvements can qualify for immediate expensing alongside your equipment purchases.

3. Enhanced Section 179 Expensing

The OBBB increases the Section 179 deduction cap from $1.25 million to $2.5 million, with phase-outs beginning at $4 million (up from approximately $3.1 million). This means the deduction is fully phased out at $6.5 million in equipment purchases, and these amounts will be indexed for inflation starting in 2026.

Strategic consideration: Section 179 and bonus depreciation have different rules, so careful planning can help manufacturers choose the optimal approach for their specific situation and state tax considerations.

4. Full Expensing for Domestic R&D Costs

The OBBB fixes one of manufacturing’s biggest tax pain points by reinstating immediate expensing of domestic research and development costs under new Section 174A. Automation projects often include custom software development, process engineering, systems integration, and prototyping, all of which may qualify for immediate deduction.

Catch-Up Provisions for Previously Capitalized Costs: For domestic R&D expenses capitalized during 2022-2024, manufacturers have three options:

- Continue the current 5-year amortization schedule

- Elect to deduct all remaining unamortized costs immediately in 2025

- Elect to deduct remaining costs ratably over 2025 and 2026

Small Business Bonus: Manufacturers meeting the small business definition (under $31 million in average gross receipts over three years) can elect to amend 2022-2024 returns to retroactively apply immediate expensing.

Important limitation: Only domestic R&D activities qualify—foreign R&D costs continue to be amortized over 15 years.

5. Advanced Manufacturing Credits: Opportunities with New Restrictions

The bill retains the Section 45X advanced manufacturing production credit for producing qualifying components like solar panels, wind turbine parts, battery components, and critical minerals domestically. However, significant changes include:

Key Changes:

- Wind energy component credits expire for products produced and sold after 2027

- New foreign entity restrictions that could disqualify businesses with certain ownership structures or supply chain connections

- Enhanced documentation requirements for domestic content

Foreign Entity Compliance: Manufacturers must ensure they don’t receive “material assistance” from Prohibited Foreign Entities above specified thresholds, and detailed supplier certifications may be required.

Note: While these credits are narrowly focused, manufacturers producing automation components or systems that feed into renewable energy projects should evaluate potential eligibility.

6. Critical Deadlines and Compliance Requirements

Many OBBB incentives come with strict timing requirements that manufacturers must understand:

Immediate Action Required:

- Wind and solar projects must begin construction within 12 months of July 4, 2025 to qualify for certain renewable energy credits

- Some clean energy credits terminate entirely for projects placed in service after December 31, 2027

- Electric vehicle credits end for vehicles acquired after September 30, 2025

Documentation Requirements:

- Proper substantiation of domestic content percentages

- Foreign entity compliance certifications

- Construction start and placed-in-service date documentation

7. Real-World Example: Comprehensive Tax Savings

Consider a Wisconsin manufacturer investing in comprehensive automation:

Investment Scenario:

- $2 million in robotic equipment and AI systems

- $500,000 in facility improvements for automation layout

- $300,000 in custom software and integration costs

Tax Benefits Under OBBB:

- Equipment: $2 million immediate deduction via bonus depreciation

- Facility: $500,000 immediate deduction via QPP election (if qualifies)

- Integration: $300,000 immediate deduction via R&D expensing

- Total First-Year Deduction: $2.8 million

- Potential Tax Savings: $588,000+ (at 21% corporate rate)

This dramatically improves project ROI and cash flow compared to traditional depreciation schedules.

8. Important Limitations and Risk Factors

Foreign Entity Restrictions: The OBBB introduces complex rules around “Prohibited Foreign Entities” that could disqualify tax benefits for manufacturers with certain foreign ownership structures or supply chain relationships. This includes restrictions based on ownership percentages, debt holdings, and “material assistance” from specified foreign entities.

Compliance Penalties: The legislation imposes significant penalties for non-compliance, including 20% accuracy-related penalties for overstated benefits and potential six-year statute of limitations extensions.

State Tax Considerations: While federal tax benefits are substantial, manufacturers must also consider how these elections affect state tax positions, which may not conform to federal treatment.

Next Steps for Manufacturers

Given Chortek’s deep expertise serving manufacturers, 40+% of our client base, we understand both the technical tax requirements and the operational realities of automation investments. Our integrated approach combines traditional tax planning with technology implementation support through our managed IT services and ERP expertise.

Immediate Actions to Consider:

- Re-examine Current Projects: Identify planned 2025 automation investments that could benefit from accelerated depreciation.

- Review R&D Costs: Evaluate the optimal approach for deducting previously capitalized domestic R&D expenses.

- Assess Foreign Entity Exposure: Review ownership structures and supply chains for potential disqualifying foreign entity connections.

- Plan Asset Timing: Coordinate acquisition and placed-in-service dates to maximize available benefits.

- Model Cash Flow Impact: Quantify the effect of immediate expensing on project ROI and financing needs.

Chortek’s Manufacturing Advantage: With over 75 years of serving Wisconsin manufacturers and specialized expertise in manufacturing accounting, tax planning, and business technology integration, we can help you navigate both the tax planning and implementation aspects of automation investments. Our team understands the unique challenges manufacturers face and can provide comprehensive support from initial tax modeling through ERP integration and ongoing managed IT support.

Contact our manufacturing specialists to explore how the One Big Beautiful Bill provisions can accelerate your automation strategy while maximizing available tax benefits. Let us help you turn these new incentives into competitive advantages.

This analysis is based on current legislation and general tax principles. Individual circumstances may vary, and professional consultation is recommended for specific situations.