Here’s how you can make 1099 filing a breeze

With year end around the corner, it’s time to take a look at Form 1099-MISC, Miscellaneous Income, which you are required to file by January 31, 2020. The most common reasons to file this form include amounts paid to contractors that are not employees, rents and royalties received, and certain payments to attorneys.

Here are a few friendly tips to assist you in the 1099 filing process, especially avoiding penalties for failure to file, late filing, and failure to file correct information:

1. Before year end, start a review of your records to determine what payments may require the filing of Form 1099-MISC.

Contractors are the most common example, followed by rental income paid to you.

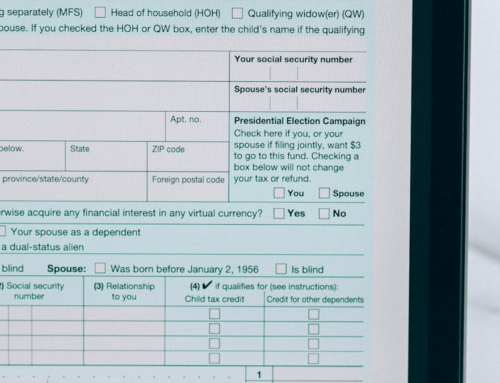

2. After identifying what payments may require a 1099, review your records for the required information: The recipient’s name; recipient’s social security number, EIN, or ITIN; recipient’s mailing address; and the total amount and type of payment to report.

If you have not been collecting this information throughout the year, you should send Form W-9, Request for Taxpayer Identification Number and Certification, to the recipient to obtain the information. For best practice, this form should be completed by the recipient before you make payments to them. Therefore, include the receipt of a completed Form W-9 as an initial step when setting up a vendor. Periodically request updated information through this form to ensure you have the most up to date mailing address, etc. For more information about Form W-9, go to IRS.gov, click Forms & Instructions, and type W-9 in the search box.

3. For information regarding what payments are required on for 1099 filing, we suggest you view the “General Instructions for Certain Information Returns.”

These instructions can be found on the IRS.gov website. Click Forms & Instructions and type 1099 in the search box. Once the list appears, select General Instructions for Certain Information Returns (Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G) – or click the link above.

4. Review your accounting records to ensure that all required payments are included for 1099 filing.

Generally, you are required to issue a Form 1099-MISC if you paid at least $10 in royalties, payments in lieu of dividends, or tax-exempt interest; or $600 in rents, for services performed by non-employees, prizes and awards, or payments to an attorney. A comprehensive list can be found on the IRS’ website.

5. If you use accounting software to export lists for Form 1099 preparation, it is extremely important to make sure the setup of vendors is complete and accurate.

A thorough check of your system and vendor setup is always a good idea before producing lists in order to assure all necessary vendors and the accurate amounts are indicated appropriately.

6. You can find information regarding penalties relating to 1099s on the IRS website.

If you need any assistance or clarification regarding Form 1099s, please contact Josh Kaiser at 262-522-8250. We also can assist you with the proper setup of your accounting system to obtain the necessary 1099 information.