What the 1099-NEC Coming Back Means for your Business

The 1099-NEC is coming back, and will be taking effect for non-employee compensation that is paid in 2020. What caused the change, what do you need to know about the forms, and how will this change how you report going forward?

1099-NEC: A New Classic

We’ve seen some people joke that retro is in, and that the 1099-NEC coming back is another example of something rebooted coming back into fashion. A required form until the 1980s, the 1099-NEC is used to report non-employee compensation. It was later changed to be reported all on one form, the 1099-MISC. But those rules will be changing back, and the 1099-NEC forms will be required for 2020 reporting.

1099-MISC Reporting Due Dates Just Got Simplified (Sort Of)

The way the 1099-MISC works right now is that if you have non-employee compensation to fill out, you would have to file the form before January 31, and if not, you could file by March 31. The difference in due dates on the same form have led to confusion, potential for fraud, and additional paperwork. For the 2018 forms, any 1099-MISC that was processed after January 31 often resulted in IRS notices and the imposition of late filing payments, regardless of whether the 1099-MISC contained compensation or other items.

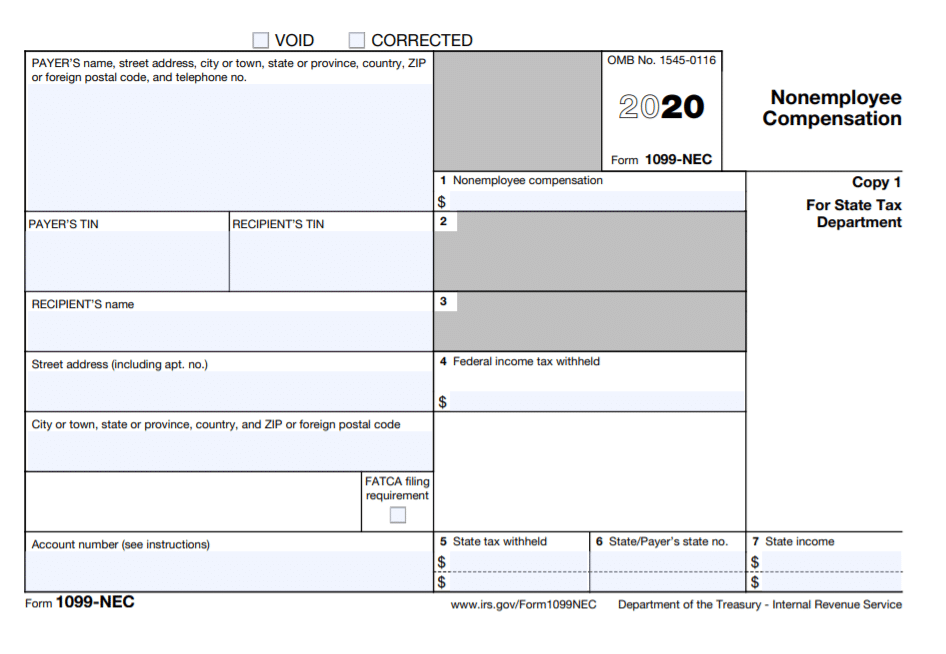

Starting with 2020 reporting, the 1099-NEC will be due on January 31, and the 1099-MISC will be due March 31. Here’s what the 2020 form will look like:

What You Need to Know About the Change

What do you need to do about this change right now? The changes will take place in 2020, so we’re writing about this now to keep you informed and prepared. For our clients, we’ll be moving non-employee compensation payments from the 1099-MISC to the 1099-NEC when the form takes effect.

Want to keep up to date on 1099 changes? Follow our blogs, subscribe to our newsletter, and stay informed!