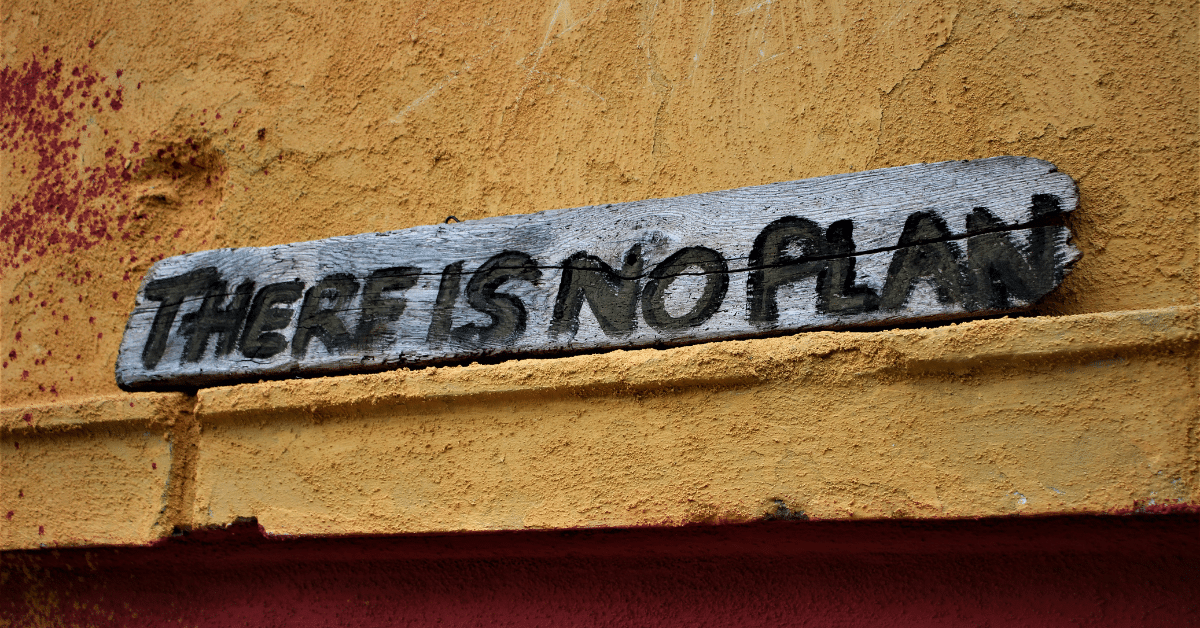

What does a succession plan look like when you don’t have a plan?

Imagine being the only child of parents who run a company. You live in a different city from your parents, know nothing about their business, and don’t know what plan they have for the future of the company. Then, both parents die within 3 months of each other. There’s no succession plan for the family business, so you get a phone call. What happens next?

Maybe you remember a few names, flip through a Rolodex, and try to figure out what to do. With no guidance, the process may become so confusing that you give up midway through. You sacrifice the business, liquidate the assets, and leave all the employees needing to find new jobs.

What is the importance of succession planning?

This sounds like a nightmare scenario, but it’s inspired by real events. And the truth is, as a business owner, you need to be prepared for any eventuality, including what it will look like for your business to live on without you. Right now, you could have a thriving business with great employees, a book of customers, and a backlog of work. However, if something suddenly happens to you and you can no longer run the business, everything could disappear in an instant. All that hard work could evaporate. The importance of succession planning can’t be overstated. It can mean the difference between an earnout and a fire sale.

Talking about your own demise or incapacitation is not pleasant. How can you plan what you can’t imagine? But the reality remains – you have to plan, especially for the outcomes you can’t readily imagine. Unfortunately, some companies learn about the importance of succession planning when it’s already too late.

You never know what the future holds. We’d like to think we’ll be around for our business forever, but we need to prepare for the inevitable. At some point, you will need to leave your business and have a plan for what’s next.

What happens if you don’t have a succession plan?

To speak more about effective succession planning, let’s explore what could happen when you don’t have a plan, both with short-term and long-term implications.

Short-Term Implications

In the short term, not having a succession plan could mean you lose things fairly quickly. You can lose employees, customers, and rapidly decrease the value of your business. Without a plan, your business can lose its ability to operate and pay employees, vendors, and possibly the bank if there’s still a loan involved. If there’s no leader for the business, it can pose myriad problems when something catastrophic happens. Your business could suffer severe penalties if there isn’t anyone to oversee coverage of payroll taxes or filing of certain forms. If nobody is designated to make sure these regular tasks get done, everything can come to a halt.

When it comes to short-term implications, failing to plan means you can harm the value of the business and its ability to serve the community, employees, and stakeholders. Anyone who gets left behind, be it family members or others, will be in a bad position. They are dealing with something they may not know anything about or enough about but still have the responsibility to sort out the business.

Long-term Implications

Failing to plan for the future means there will be a lot of unanswered questions in the long term. Do you want to keep business ownership in the family? Do you want to hire someone to run it, or should someone step in? If there isn’t a plan, is there a way to position the business for sale in such a way that it doesn’t feel like an emergency situation? Without a succession plan in place, this can prove to be tricky.

In the long-term, you need to think about the following:

- Who would be a possible buyer to talk to?

- Who could you use to sell the business?

- What would be important before that happens? (Example: Get business software to improve processes)

- What is the exit strategy? Are there non-compete agreements you need to give to key employees and add value?

- What can be done to minimize the tax impact on a sale?

- Are you counting on the value of the business to provide financial security and independence for your family?

Not having a plan in place can leave these questions unanswered and put the value and future of your business in jeopardy.

How can you prevent the worst from happening?

A business continuity plan is key in helping you prevent the worst-case scenario. Think of an envelope that says “open this in case of emergency.” That’s a business continuity plan. The plan should include who the key contacts are for the business, such as your attorney, accountant, and insurance agent. You could also appoint someone internal or external to provide advice and guidance in managing the business via the plan. These measures are meant to help the business survive in the short term.

Having a business continuity plan is important for anyone you may care about in the scenario that your time with your business may come to an end. Family members, key employees, or the community at large could be included in your consideration.