What is the Families First Coronavirus Response Act?

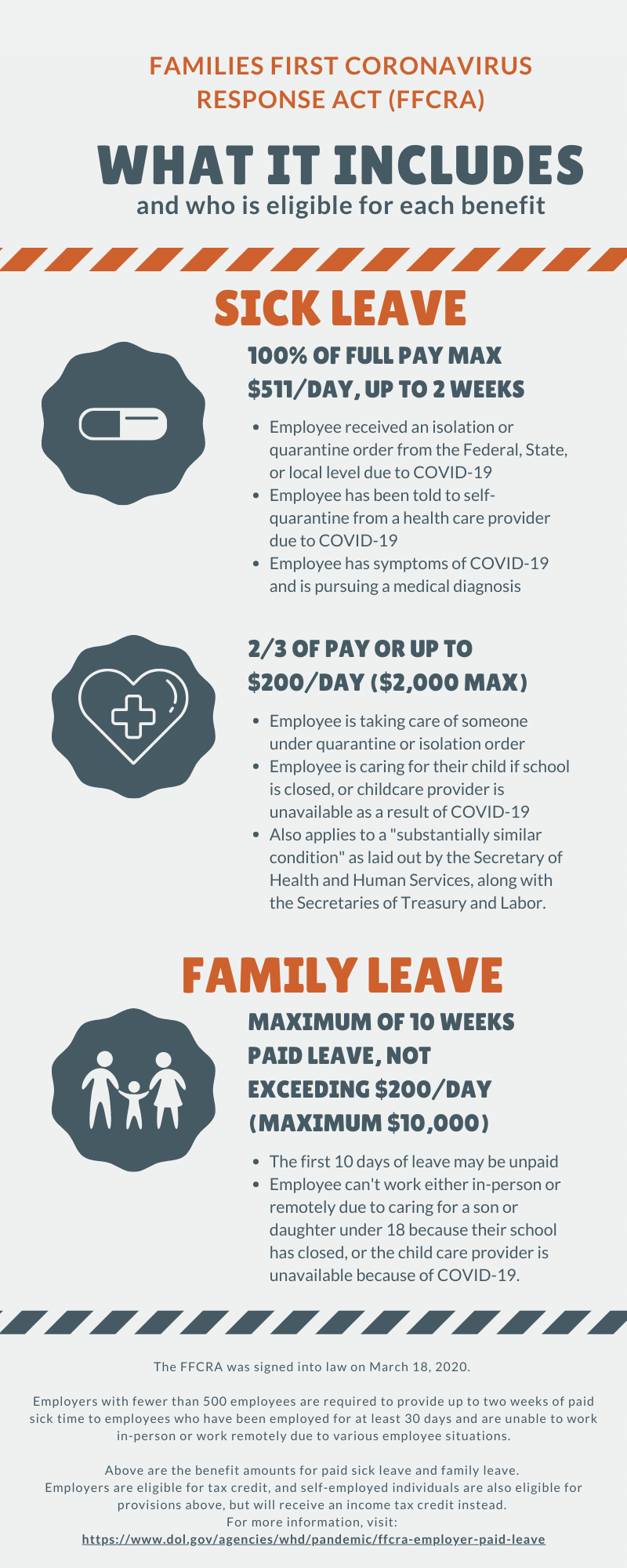

The FFCRA was signed into law on March 18, 2020.

Employers with fewer than 500 employees are required to provide up to two weeks of paid sick time to employees. Employees are included if they have been employed for at least 30 days and are unable to work in-person or work remotely due to various employee situations.

On the infographic below, you can find the the benefit amounts for paid sick leave and family leave.

Employers are eligible for tax credit. Self-employed individuals are also eligible for provisions above, but will receive an income tax credit instead.

For more information, visit The Department of Labor‘s website.

If you’re looking for more information Chortek has put out about the novel coronavirus, please visit our COVID-19 Resource Page.

Infographic: Employee Benefits per the Families First Coronavirus Response Act

Text from the Infographic on FFCRA

Sick Leave

100% of full pay max $511/day, up to 2 weeks

- Employee received an isolation or quarantine order from the Federal, State, or local level due to COVID-19

- Employee has been told to self-quarantine from a health care provider due to COVID-19

- Employee has symptoms of COVID-19 and is pursuing a medical diagnosis

2/3 of pay or up to $200/Day ($2,000 max)

- Employee is taking care of someone under quarantine or isolation order

- Employee is caring for their child if school is closed, or childcare provider is unavailable as a result of COVID-19

- Also applies to a “substantially similar condition” as laid out by the Secretary of Health and Human Services, along with the Secretaries of Treasury and Labor.

Family Leave

Maximum of 10 weeks paid leave, not exceeding $200/day (maximum $10,000)

- The first 10 days of leave may be unpaid

- Employee can’t work either in-person or remotely due to caring for a son or daughter under 18 because their school has closed, or the child care provider is unavailable because of COVID-19.